Offering robust company health insurance plans is essential for retaining and supporting your employees. These plans guarantee coverage for a {widearray of medical expenses, including hospitalization. By offering comprehensive health insurance, companies can show their commitment to the well-being of their employees, eventually leading to a more productive and successful work environment.

Investing in Employee Wellness: The Power of Company Health Insurance

Investing in employee wellness is no longer just a nice-to-have perk for forward-thinking companies. It's a critical component of creating a thriving employee ecosystem where individuals feel supported. And at the heart of this wellness initiative lies company health insurance, a powerful resource that can positively influence both employee well-being and overall business success.

A comprehensive health insurance plan offers employees peace of mind knowing they have access to quality healthcare services. This reduces stress related to unexpected injuries, allowing employees to focus on their work. Moreover, a robust health insurance plan can attract and retain top talent by demonstrating the company's investment in people.

The benefits of investing in employee wellness through health insurance extend beyond individual employees. Studies have shown that companies with strong wellness programs often have reduced absenteeism. This translates into greater financial stability for the company as a whole.

Understanding the Complexities of Company-Sponsored Health Insurance

Navigating the world of company-sponsored health insurance can be a challenging task. With diverse plan options available, it's essential to meticulously consider your personal needs and {preferences|. Employers often offer a range of plans with varying levels of coverage, contributions, and copayments. , Moreover factors such as network size, prescription drug coverage, and services can significantly affect your overall health care expenses.

To make an informed decision, it's essential to review the available plans meticulously. Leverage resources such as your company's human resources department, online plan comparison tools, and third-party insurance advisors.

By comprehending the intricacies of company-sponsored health insurance, you can optimally manage your healthcare costs and ensure more info adequate coverage for yourself and your loved ones.

Securing Your Future: Understanding Company Health Benefits

Navigating the world of company compensation can be a daunting task. It's crucial to understand what your employer offers, especially when it comes to health insurance. A robust health benefits package can provide protection for you and your loved ones, ensuring access to essential treatment when needed.

Take the time to review your company's offerings carefully, paying attention to premiums, deductibles, and plan details. A well-informed choice can have a significant effect on your overall financial health.

- Investigate different types of health plans available to you.

- Analyze the benefits of each plan carefully.

- Speak with your benefits administrator for clarification

Cost-Effective & Equitable: Essential Aspects of Corporate Health Coverage

When seeking comprehensive healthcare coverage, company health insurance offers a beneficial resource. To ensure it meets the needs of all employees, reputable plans prioritize affordability and accessibility. This means offering reasonable rates that fit diverse budgets and providing a broad range of healthcare professionals to ensure convenient access to care.

- Additionally, many company health insurance plans offer essential benefits such as hospitalization coverage, prescription drug assistance, and preventive care options. These features work together to create a comprehensive safety net for employees and their families.

Understanding these key features can help you choose a company health insurance plan that best aligns with your individual and family's needs.

Choosing Your Coverage: Maximizing Your Health Plan

With the vast array of health insurance plans available, determining the optimal coverage for your needs can feel overwhelming. All individual's circumstances are unique, meaning a plan that suits one person may not be ideal for another. To guarantee comprehensive protection while staying within your budget, it's crucial to carefully evaluate your options. Initiate by identifying your primary healthcare needs and consider factors such as premiums, deductibles, co-pays, and out-of-pocket caps.

- Investigate various health insurance providers and analyze their plan offerings.

- Consult your doctor or a trusted healthcare professional for personalized recommendations based on your medical history.

- Employ online tools that allow you to quickly compare plan details side-by-side.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Rachael Leigh Cook Then & Now!

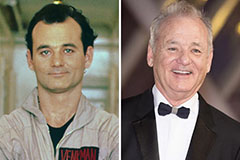

Rachael Leigh Cook Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!